Emerging Markets: A Strong Year, a Stronger Outlook

Franklin Templeton Emerging Markets Equity’s Manraj Sekhon highlights structural advantages in emerging markets in his 2021 outlook.

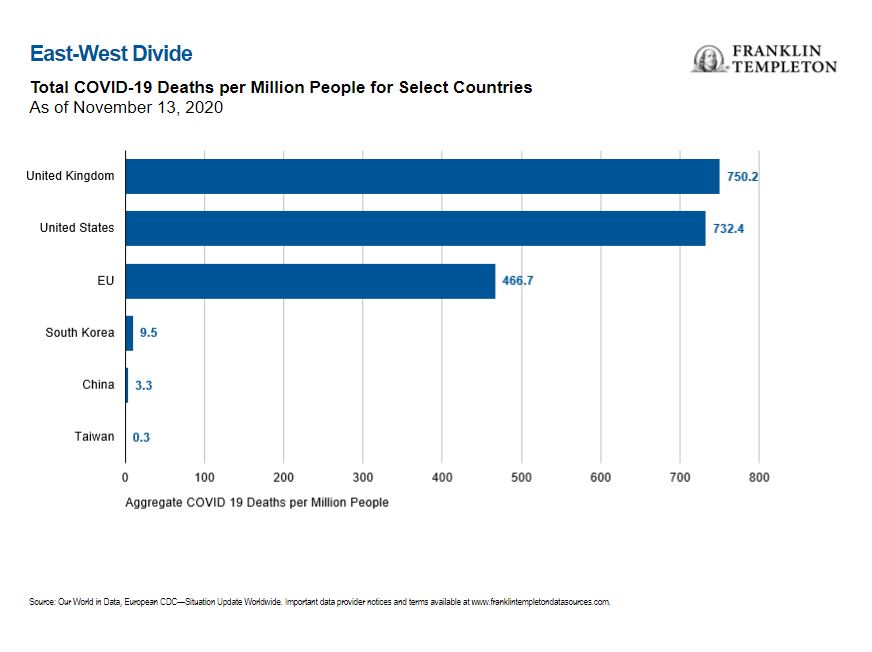

2020 has been a testing year—literally and figuratively—with terms such as “safe haven” acquiring new salience. Across countries, sectors and companies there have been clear winners and losers from COVID-19, which in some instances have confounded expectations. It is clear that key emerging markets, particularly in East Asia, have substantially outperformed other countries in terms of health outcomes, economic impact and equity markets.

Economies and markets globally have thus far primarily been affected by the first-order impact of COVID-19, including lockdowns and movement restrictions, as well as near-term supply chain and consumption disruptions—resulting in significant GDP (gross domestic product) declines.

Over 2021, we expect the second-order effects of COVID-19 to become more evident. These would include fiscal and monetary macroeconomic risks resulting from the unprecedented stimulus policies pursued globally to mitigate the effects of the pandemic. In addition, inequality has been exacerbated globally both within and between countries, increasing the risks of political instability. Less susceptible to these risks will be those countries that were better able to minimize disruption during 2020, notably East Asian emerging markets.

We expect COVID-19 to remain prevalent in 2021—while the outlook for a vaccine is improving, production and distribution in sufficient scale are challenges equal to its development. As such, we expect countries to continue to experience sporadic COVID outbreaks, which will add volatility to the underlying trend of economic and market recovery.

Gravitating Toward Strength

As recovery becomes more widespread across emerging markets, led by East Asia, this improves earnings visibility, enabling a broadening of market performance. Many companies have successfully executed during the pandemic and should emerge out of the crisis in a stronger competitive position—and not only the commonly recognized COVID-19 winners. We continue to closely monitor the pace of recovery in what we consider good quality companies that have corrected significantly beyond the limited near-term impact to their intrinsic value.

East Asia remains well placed to lead global markets. China is expected to be alone in seeing GDP growth in 2020, underpinned by a diversified domestic economy driven by innovation and digitalization. We continue to see the emergence of high-quality companies that are well-placed to benefit from ongoing market consolidation and booming domestic consumption. Taiwan and South Korea are beneficiaries of the structural growth in information technology (IT) hardware, as well as the diversification of global technology supply chains.

Geopolitical tension between China and the United States remains a key headwind likely to persist irrespective of the US president. Although this is resulting in decoupling between the two countries in the technology sector, we have seen continued liberalization in China’s financial markets, driving increased foreign ownership. Investor interest in China’s domestic A-share markets is rising alongside increased bond market flows as China is added to international indexes.

It is likely that with a new US administration we’ll see a shift to a more constructive tone, although longer-term strategic tension will remain. Regardless of this, the economic imperative for US companies to grow, develop and sell into—as well as source from—China will ultimately drive US policy.

Next Wave of Recovery

The ASEAN (Association of Southeast Asian Nations) region and India have lagged in terms of COVID-19 normalization but are gradually re-opening, with macroeconomic recovery supported by the favorable demographics of younger, less susceptible, populations. The case for foreign direct investment is being improved by regulatory change and global supply chain diversification, while the significant scope for consumption growth from a low base also bodes well over the longer term.

India has seen surging COVID infections, but with mortality having been contained, economic reopening has continued. Although the disruption of traditional business models has weighed on some companies, we expect to see a positive impact on Indian technology service providers. Largely ignored over the last few years due to slowing growth and margin pressures, the IT services sector has been supported by both higher client traction as well as structural cost saving initiatives. The resurgence of manufacturing activity, as India embarks upon indigenization and import substitution, as well as global efforts to diversify supply chains could drive demand across a range of product categories, including electronics, defense, automobile parts and pharmaceuticals. Normalization of credit stress on the back of falling interest rates and improving liquidity should have a positive impact on banks, an area where we maintain a positive outlook. Meanwhile, negative real rates in India will provide very significant support for the economy and markets going forward.

In Latin America, COVID-19 has accelerated a trend of low interest rates and digitalization. Simultaneously, a strong global rebound in the manufacturing supply chain has boosted metal prices, supporting the region’s mining industry after a long cycle of underinvestment and weak currencies.

Brazil, despite the political noise, has continued to focus on important economic reforms that are leading to a structural downward shift in its historically high real interest rate. The central bank has also cut its policy interest rate to a record low, which reduces the cost of renegotiating or restructuring loans, and could be a catalyst for longer-term credit growth. Credit penetration in Brazil is far below many other markets, signaling room to head higher in the coming years, supporting the prospects for the financials sector. More broadly, negative real rates will provide structural support to Brazil’s growth outlook. We are also witnessing a long-term trend of “equitization” of investments that benefits participants in the financial services industry.

Challenges remain in Brazil, however, including rising debt levels as a result of stimulus measures, paired with uncertainty surrounding continued economic reforms amid a politically fragmented environment. This may in turn place upward pressure on longer-term interest rates. The planned end of emergency aid in place to support those impacted by lockdown measures could also impact economic recovery.

Even in South Africa, an emerging market that has stagnated in recent years, there is cause for optimism. The outlook is improving under President Cyril Ramaphosa, with announcements of a host of reform measures and redirection of public spending, including infrastructure projects, initiatives to support re-industrialization, spending cuts (centered on a civil servant wage freeze) and efforts to address corruption. There have, however, been false dawns before in the Rainbow Nation.

A Better Future

The challenges of 2020 have highlighted structural advantages and other beneficial secular trends in emerging markets that bode well for 2021. The resilience of key markets in East Asia during the crisis, paired with their ability to capitalize on secular shifts to the new economy, should drive continued strength next year. Laggards, including India and Brazil, will likely benefit from a uniquely accommodative environment of negative real rates (and an undervalued currency in Brazil), paired with ongoing reform efforts and excess capacity in the economy, boosting growth.

This broadening of economic recovery should continue to drive improved earnings visibility into 2021 and amounts to a compelling opportunity across emerging markets as a whole—both from a near-term tactical perspective as well as structurally. For so many different markets across this landscape to concurrently offer compelling investment potential, individually and in aggregate, presents an exceptional investment window, in our assessment.

What Are the Risks?

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in developing markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with developing markets are magnified in frontier markets.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com—Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton’s U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

Related Articles

Investor Sentiment Around the World

Franklin Templeton’s 2015 Global Investor Sentiment Survey (GISS)1 revealed a number of interesting observations about investor beliefs, misconceptions and biases—and

The Impact of US Policy on Emerging Markets—Dollar Concerns “Overdone”

Continued US dollar strength has focused attention on weaker commodity prices and dented investor enthusiasm for emerging markets in recent

Malaysian economy – On the road to recovery

The Malaysian economy is the best among a group of emerging markets, and it has done it without international help.