We truly live in a global economy, and climate change—including its causes and potential impacts—has been one of the biggest issues of discussion and debate today. It’s a galvanizing topic, but one that has the potential to create many disruptions around the world, as well as potential opportunities. And emerging markets are front and center.

The Rise of Emerging Markets

One thing that’s not up for debate is the rapid rate of growth of emerging markets over the past few decades, leading to some impressive transformations. However, this explosion of growth and development in emerging markets has also led to increasing pressures on the environment. China is now regarded as the second-largest economy in the world only behind the United States and is a global leader in a number of areas. In the 40 years since Deng Xiaoping led China’s economic reform to embrace a “socialist market economy,” there has been tremendous growth in wealth in China, moving millions of people out of dire poverty and dramatically improving the quality of life in the country. This, of course, has been positive, but rapid growth and industrialization can come with consequences, particularly in areas such as environmental degradation and climate change.

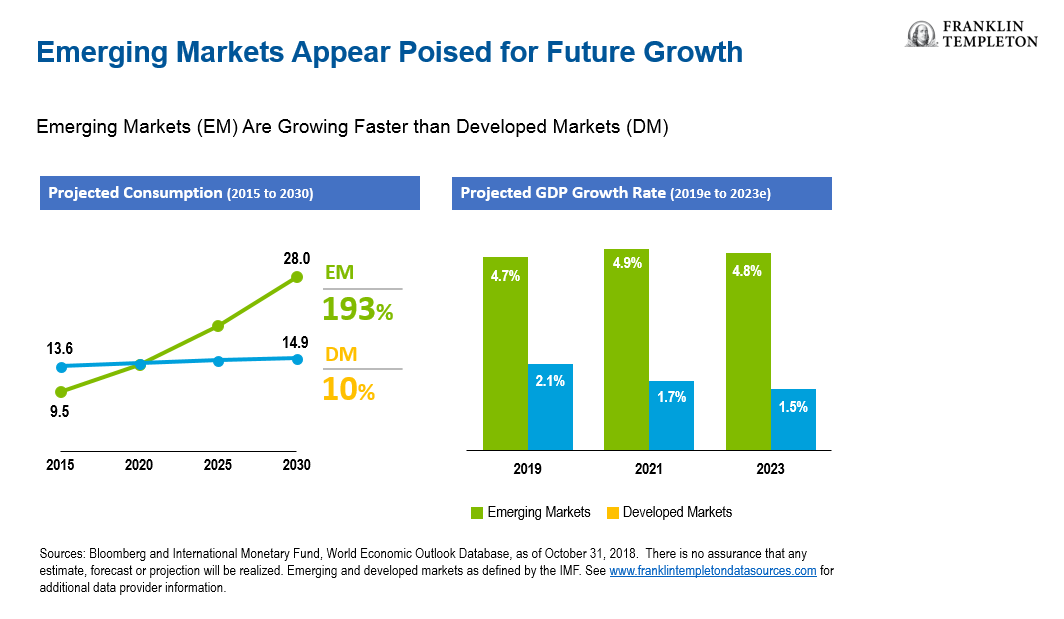

Of course, China certainly isn’t the only emerging market to experience rapid economic growth and development. Of the top 10 largest economies today, three are in emerging markets, and growth rates in emerging markets overall are expected to outpace those of developed markets this year and beyond.1

Market liberalization and globalization have led to tremendous growth in consumption both in emerging and developed markets. (See chart below)

Growth of a Global Consumer Culture

Once largely a developed-market designation, a new middle class has emerged in emerging markets. And these consumers have more discretionary income to spend. Take air travel, for example. In 1978, there were 378 million global airline passengers—today, there are 4 billion.2 In 1978, China saw 1.5 million passengers travel by air, while 2017 saw more than 551 million air passengers. The growth in air travel comes with corresponding consequences—more aircraft results in more fuel usage and more greenhouse gas emissions, which can be detrimental to the environment.

There are many examples of how globalization and increased trade have contributed to a rise in consumption of all types of consumer goods. Clothing is one example. Americans buy five times more clothes today than they did in 1980—and if you live in the United States or Europe and look at the tag on your blouse or shirt, the odds are high its origin isn’t your home country. Of the world’s top 10 producers of textiles and clothing, eight are in emerging markets.3

Textile production requires large amounts of water and creates polluting emissions. With today’s emphasis on “fast fashion” it can also result in a lot of waste.

Emerging markets are supplying many goods and services that power the world. Increased production of goods requires more electricity, and this electricity has been produced mainly by burning fossil fuels. Global coal production increased from 3.3 billion short tons in 1980 to 8.2 billion short tons in 2010.4 While China leads in coal production, the Chinese government has been promoting green-energy policies, including the use of solar. Global use of coal has been declining in recent years, but nonetheless, it remains a substantial source of electricity generation.

The Cost of Growth

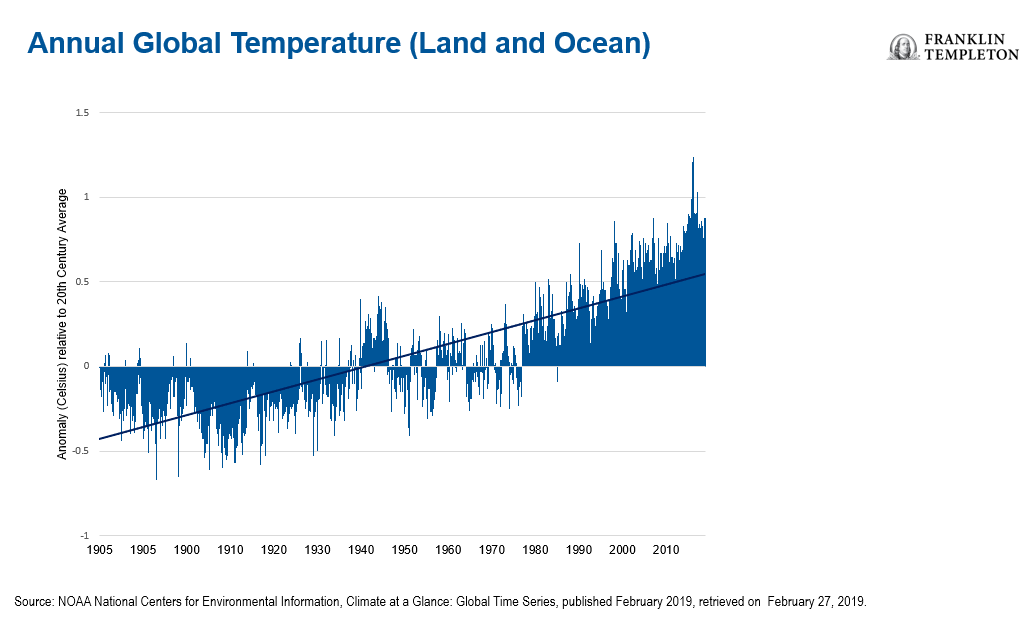

While growth and development no doubt benefit many people across the world, often a solution to one problem brings another one. While millions of people have emerged from poverty, our dependence on fossil fuels has arguably led to climate change, which is now generally perceived as one of the biggest risks to the global economy and the world as a whole. Emissions from the use of fossil fuels are generally accepted as a key contributor to climate change.

Climate change brings serious impacts to the investment world, too. We see four types of risk associated with climate change and its influence on investments.

- Long-term risks which may impact the competitive position of whole countries or even regions in the global economy. According to the World Bank, climate impacts could push 143 million people across three developing regions to become “climate migrants,” who are forced to leave their homes in search of more viable habitats.5 And, food supplies could also be significantly pressured. Low-lying coastal regions are vulnerable to sea-level rise and the increased occurrence of intense storms. This would impact a country like Bangladesh, for example. Another example would be West Africa, which is dependent on cocoa production. Climate change could make it impossible to grow cocoa in this region in a few years’ time, and it may have to shift towards other crops as a result. “Climate smart” agriculture could prove a necessity for certain crops to survive—and could also represent interesting investment opportunities.

- Short-term impact on commodity prices due to adverse weather events. Adverse weather events are becoming more frequent. The scientific community at large generally regards changing ocean-current patterns amid the changing climate as a contributor to these weather changes. For example, coking coal prices soared in 2011 as a result of heavy floods in Australia, which is one of the world’s largest coking coal exporters. The World Economic Forum’s 2019 “Global Risks Report” puts extreme weather conditions and climate change policy failures as the risk with the biggest threat over a 10-year horizon.6 El Niño and La Niña are periodic changes in Pacific Ocean sea surface temperatures that impact weather across the globe, with both positive and negative effects. While not new, they can become more powerful and unpredictable with climate change. El Niño is usually negative for a country like India, as it tends to bring lower-than-average rainfall during the monsoon season, which is critical for Indian agricultural production. Peru also suffers from a negative impact on its fisheries. On the flip side, North America tends to see milder El Niño winters and a country like Argentina in South America could see a boost in soybean production.

- Short-term impact on certain companies. Changing weather patterns impact many businesses. In December 2018, for example, German chemical company BASF warned of considerably lower profits amid record-low Rhine river water levels, which weighed on its business that year. The company ships its products using barges on the river, so low Rhine river water levels constrained use of this cheap transport mode. Major apparel companies focus on promoting fall fashion collections several months in advance of the colder-weather season. However, milder and/or shorter winters have changed customer behaviors. People postpone winter clothing purchases or do not make them at all—not needing as many heavy coats, woolens and the like. Sometimes apparel companies have to make painful adjustments in the form of inventory write-downs, so there’s been a rise in a buy-on-demand model and transitional collections. Shifting temperatures and precipitation of course also impact the price of the raw commodities used to produce fabric and can impact emerging-market economies, which, as noted previously, are leading exporters of these goods.

- Greenhouse gas emissions may be taxed which would decrease companies’ profitability. The idea here is to reduce demand for products whose production process leads to heavy greenhouse gas emission. Examples would be cement production or air travel, which emit noxious substances into the environment. By taxing such products and/or services, demand would in theory be reduced and at the same time companies would invest in more “green” technologies to offer the same product and/or service, but with less impact on climate.

Part of the ESG Equation

Environmental, social and governance (ESG) factors are integrated into our investment analysis, and climate change is a key theme we are monitoring. We are aware of the potential risk that climate change poses to profits of companies we invest in. And, we think the fight against climate change will only intensify going forward. This may mean additional costs or a gradual shift in the business model for some companies.

For example, for high-impact sectors or downstream products that are large CO2 emitters, this would be a key area we would evaluate in regard to impact on operating models, as scientists believe CO2 emissions are a primary cause of climate change. The fight against climate change doesn’t only impact coal production or electricity generation. Cement production and airlines, for example, are also heavy CO2 emitters.

That doesn’t mean, however, there is no case for investing in these types of companies.

As part of our investment process, we examine how any ESG risk will impact a company’s ability to generate sustainable earnings. In addition, we actively engage with company management on best ESG practices, among other factors.

In the case of a cement producer, we would look to invest in companies with the most advanced technology that can limit CO2 emission. Airlines have a big carbon footprint and may be forced to pay for the CO2 they emit, drawing a distinction between those with older, less efficient fleets and those with newer, more efficient ones. Those with higher CO2 emissions costs may pass them on to customers, which could decrease the demand for airline travel on certain carriers.

Part of our ESG analysis involves awareness of these types of issues as we make our investment decisions. We strive to integrate ESG factors alongside our financial analysis as we assess both opportunities and risks within potential investments. This fundamental research provides an additional tool to differentiate between companies, in our view.

Opening up New Opportunities

Climate change is not only about risks. It also creates potential opportunities. One obvious one might be companies in the clean-energy space. A shift towards renewables also brings the need to create viable electricity storage solutions. We see companies in South Korea and China as likely leaders in battery development for electricity storage and for electric vehicles.

Another area we see with potential is sensor designers and manufacturers. Cellular communication 5G technology and the Internet of Things will likely improve the accuracy in tracking the use of resources like water and electricity. In addition, there has been a growing need for the elimination of waste, whether through recycling or water treatment, for example, which we think represents another area of opportunity.

These are just a few examples of opportunities climate change could create; we think there will be more as the world realizes the risks it entails. But really, that is true of any change—there are always people, places or industries that are displaced until new solutions emerge. And we are optimistic that they will.

The comments, opinions and analyses presented herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Any companies named herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton Investments. The opinions are intended solely to provide insight into how securities are analyzed. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

What Are the Risks?

All investments involve risks, including the possible loss of principal. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

_________________________________________________

1. Source: International Monetary Fund, data as of 2018. There is no assurance that any estimate, forecast or projection will be realized.

2. Source: World Bank: Air transport, passengers carried. International Civil Aviation Organization, Civil Aviation Statistics of the World and ICAO staff estimates. Data as of 2017.

3. Source: World Trade Organization, world textile and apparel trade, 2017.

4. Source: US Energy Information Administration, global coal production, data through 2010.

5. Source: World Bank, “Meet the Faces of Climate Migration,” March 19, 2018.

6. Source: World Economic Forum Global Risks Report 2019. The report presents the results of our latest Global Risks Perception Survey, in which nearly 1,000 decision-makers from the public sector, private sector, academia and civil society assess the risks facing the world.